AUSTRALIAN PROPERTY INVESTMENT TAX REPORT: EVERYTHING EXPLAINED, SIMPLY.

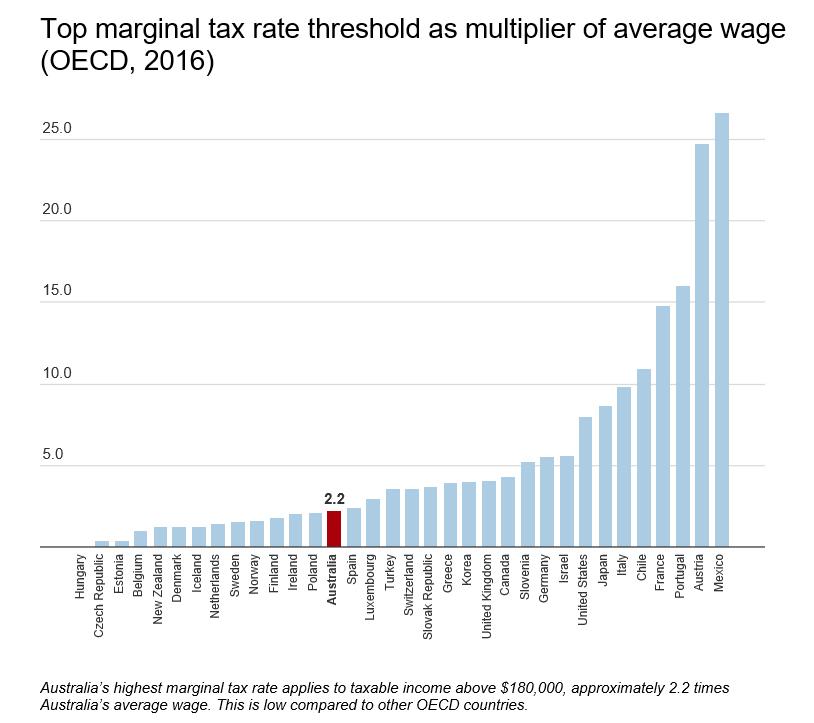

Many people think taxes are high in Australia and may not purchase property simply because of this.

This Special Free Report shows you the simple steps you can take, as well as the tax allowances you can claim, to lower, reduce and even eliminate completely all taxes on your Australian property investments.

You may be surprised at the real rates of tax you pay in Australia when investing in property. Not too far off the rates in Singapore and Hong Kong.

Little known and understood, but true. The Australian Government provides strong tax incentives for property investors.

Some expatriates living overseas are even worried about possible “world-wide” tax on their overseas income if they invest back home.

Again, a needless worry. Very few overseas investors - and expatriates- know the correct information, or even realise how the correct tax planning could benefit them hugely in the future by both reducing any potential FUTURE income tax in Australia, tax on rental or Capital Gains (profits) tax.

What Tax do Non-Residents Pay? Capital Gains Tax explained. What is "negative gearing" and how does it work? And much more!

LOOKING FOR A MORTGAGE LOAN? GO HERE TO FIND OUT MORE, Click!

BUYING PROPERTY BEFORE YOU ARRIVE IN AUSTRALIA MAY HELP YOU GREATLY REDUCE YOUR AUSSIE TAXES WHEN YOU RETURN TO LIVE.

NOT investing in property back home BEFORE you return can mean you could pay twice the amount of tax you have to after your return.

WHY YOU SHOULD CONSIDER INVESTING IN NEW RESIDENTIAL PROPERTY IF YOU WILL BE RETURNING TO LIVE IN AUSTRALIA IN THE NEXT FEW YEARS.

If you are an Australian citizen, who has been working abroad and is returning "home " soon you are no doubt looking forward to it!

You have done the hard work, and for most people they think they will leave everything else until they arrive.

HOWEVER, there are a couple of simple things that you can start to implement NOW, that could greatly enhance your lifestyle after you arrive.

Recent studies have shown that:

1. Less than 1 in 100 new migrants understand Australia's sliding scale of tax.

2. Many new migrants, and returning Australian's are fearful of the "high" tax rates.

3. Fully 80% of all Australian expatriates have put off the decision in previous years to return to Australia to live because of their dislike of "paying high tax."

4. Over 95% of new migrants arriving have no established credit record in Australia. Effectively, they have to "start from scratch."

5. Most new migrants have no banking records, or bank accounts, or credit card established in Australia before they arrive. And many long term expats are in the same position, they have "lost" their credit rating back home.

Tip One:

Decide and organise your children's schooling BEFORE you arrive if at all possible .

Talk to Australians or friends whose advice you trust. Arrange a ZOOM call with the school.

Having your children organised ahead of time will relieve an enormous amount of stress for you.

Tip Two:

THIS IS A BIG ONE. NEW MIGRANTS TO AUSTRALIA AND RETURNING EXPATS CAN LITERALLY SAVE TENS OF THOUSANDS, IF NOT HUNDREDS OF THOUSANDS OF DOLLARS BY FOLLOWING THIS STRATEGY.

Buy a new investment property (NOT your proposed new home) before you arrive, and ideally as soon as you actually apply for migration or are thinking about going home if you are an expat.

Borrow from an Australian bank for this purchase, to help with your credit before arrival.

Not one in 1,000 new migrants do this, and yet this is one of the biggest single tips to ease your way into Australian life, to reduce your income tax, maybe even to lower levels than you are paying now- and to increase your weekly "take home pay," increase your cash flow and quality of life, as well as to help establish your credit rating down under.

Very few migrants or even expats are aware that up to 60% of the purchase price of a new build apartment is available to them as a legal tax deduction after they arrive for years to come.

But the secret is, to do it as far as possible IN ADVANCE of your arrival. If you are returning home soon, or planning too, this strategy won't work as well.

HERE'S HOW IT WORKS (simplified)

(Note: These reports were written a few years ago when interest rates we much higher, however, the concept and principles remain the same)

EXPAT PROPERTY TAX REPORT

NEW MIGRANT TAX REPORT